Meteorologically, November marks the ending of Autumn and the descent into Winter. For the European financial sector it also marks open season for Investor Day strategy presentations, a season that can often last until early summer. These events come with many names – Deep Dives, Strategy Updates, Investor Days or Capital Markets Days – but their aim is essentially the same; to attract investor attention and shift the narrative away from results and onto the medium term.

In the 5 week period between early November and mid December 2025, we counted a dozen large cap UK and European financial names competing for airtime by hosting such events. Sadly three quarters of them witnessed share price falls on these Investor Days with a 1.6% decline on average.

It is dangerous territory to attach too much importance to a single day move but with a huge amount of resources going into such updates, it poses the obvious question of ‘Why bother?’

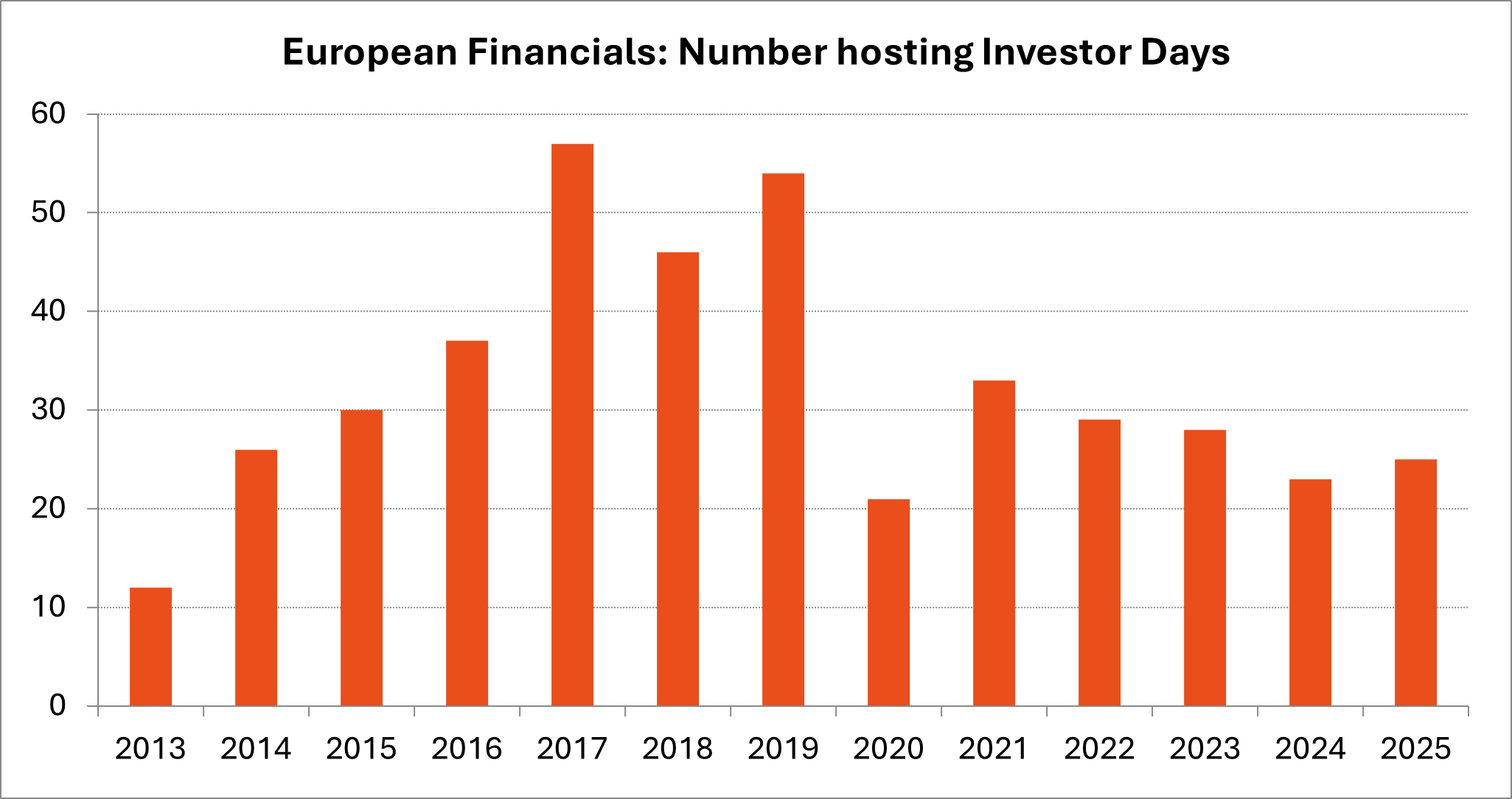

While the number of events is down from pre-covid highs it is clear that financials remain committed to Investor Days as a key communication tool. We would not expect 2026 to be any different; a number of companies have indicated that they will provide strategic updates with the publication of Full Year results, whilst others have already pencilled in Deep Dives, while still others have indicated that some form of Investor Day will take place later in the year. 2026 will see most financials using Investor Days to extend or refresh expiring targets, rather than make step changes in strategy as a result of management change or M&A.

Clearly the sector has regained and cemented investor trust over the last couple of years after 15 years of material underperformance versus the broader equity markets. The fight for investor attention is firmly on. The landscape is crowded. The question becomes what will be the role of Investor Days in sustaining investor interest and driving multiple expansion?

Despite their popularity, Investor Days are no panacea

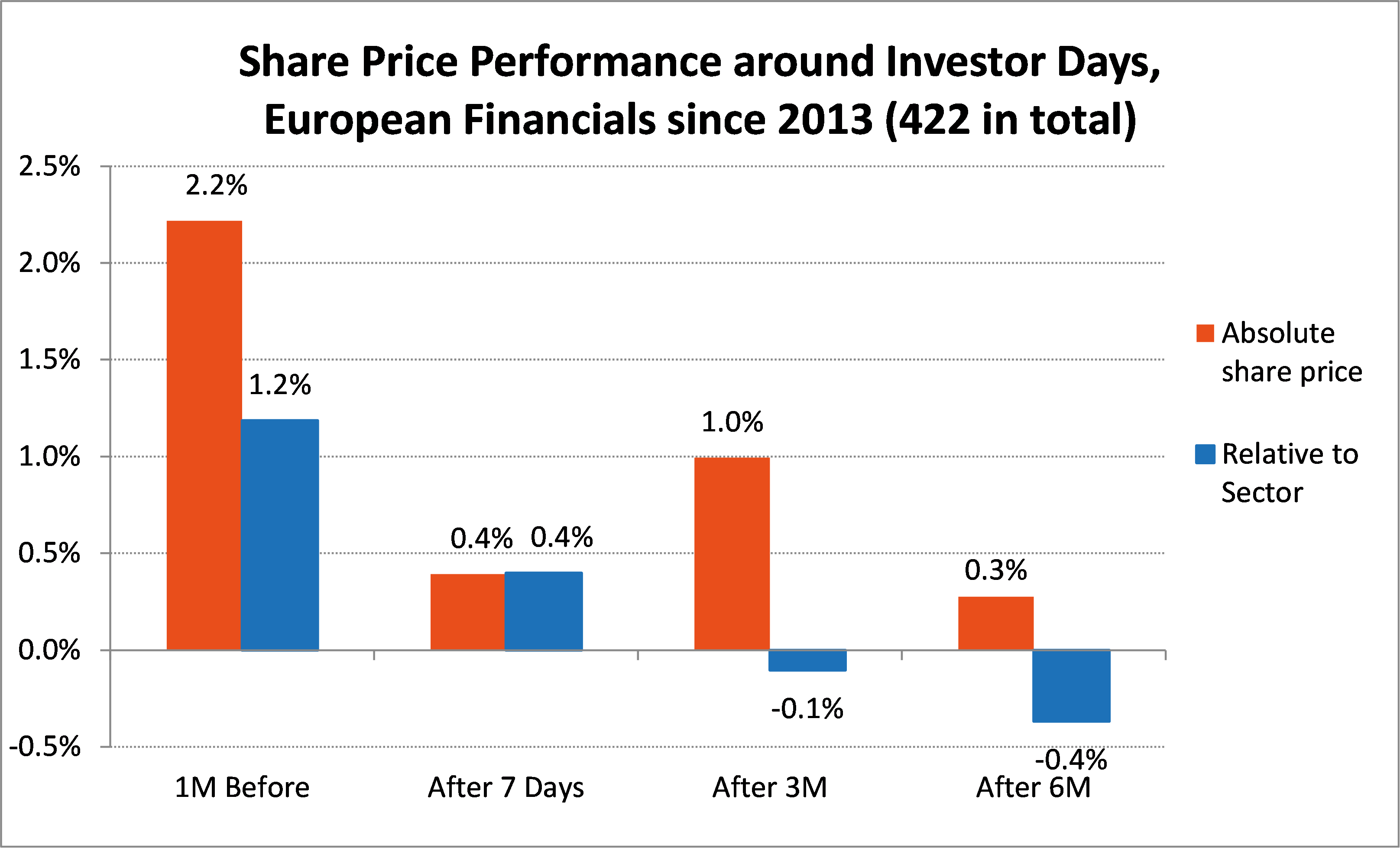

In a typical year in the mid to large cap European listed financials world around 20-30 such Investor Days take place. A typical share price pattern has emerged; in the month before the event, the share prices enjoy a ramp up, raising the bar of expectations. After all why would a management team host an Investor Day if they didn’t have something positive to announce? However, judged on the basis of share price performance in the 6 months thereafter, a majority lose that outperformance. And here, don’t get fooled between absolute over relative performance. It’s the latter which really counts.

In the chart below we have analysed the performance of European financial company share prices from over 420 Investor Day events held over the past 13 years (2013-2025). Included here are events from around 190 European banks, around 180 insurers and around 50 from Diversified Financial companies.

As can be seen, in the month prior to hosting the Investor Day in absolute terms on average the company’s share price rose by 2.2% and by 1.2% relative to the index. However, after 3 and then 6 months they start to give up this outperformance. In absolute terms it might still seem like the event was worthwhile, rising by 1% after 3 months and 0.3% still after 6 months. But when compared with the performance that would have occurred regardless from the index, the outperformance is effectively wiped out. Relative performance 6 months post event averages basically zero.

Individually there can be rewards

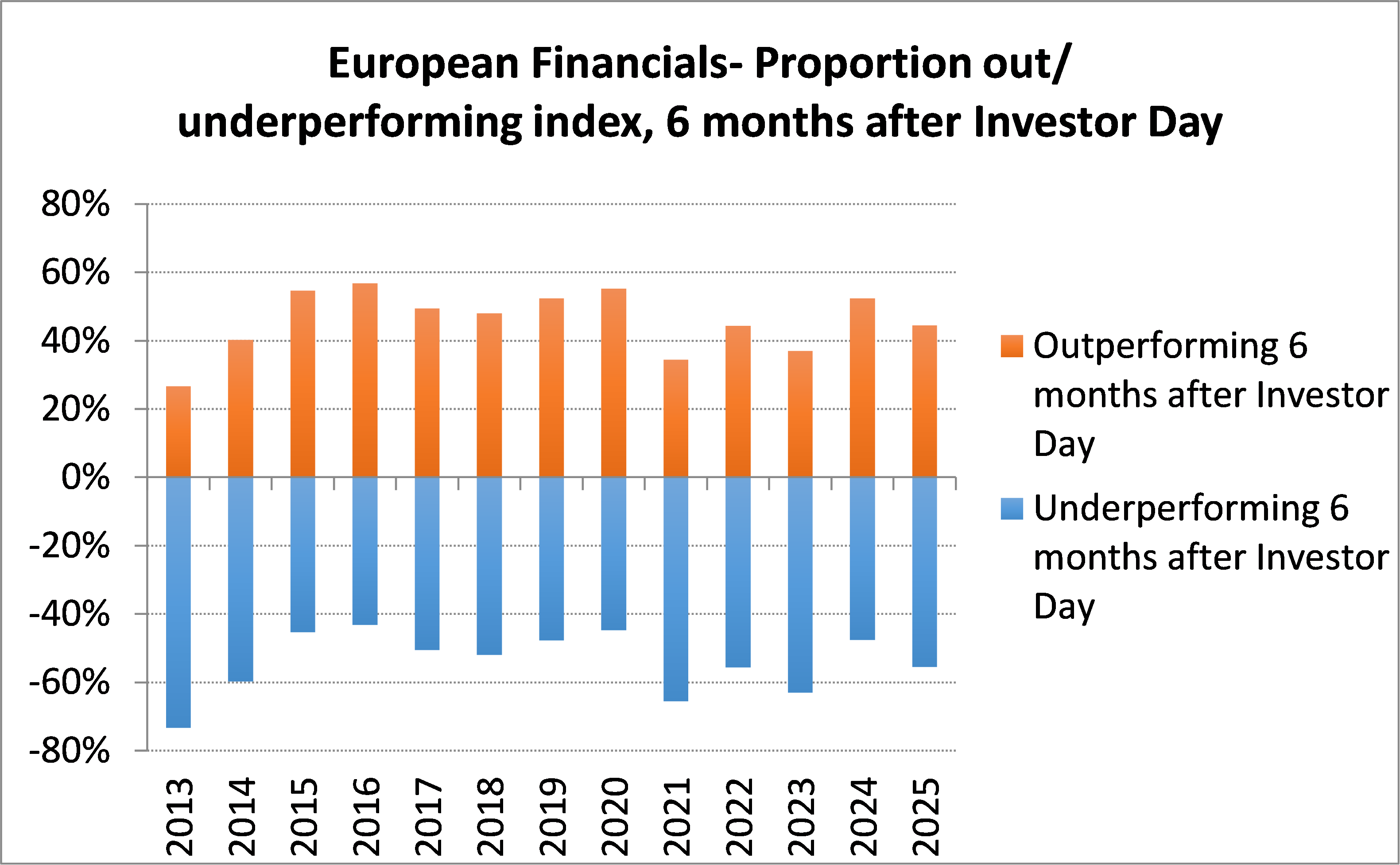

However, whilst the aggregate price performance in the 6 months after the Investor Day is relatively muted, that masks some significant individual relative outperformance and underperformance in specific years. The chart below shows the relative performance of financials broken down by the year in which their event occurred. It would seem that 2016, 2020 and 2024 were particularly good years for hosting successful Investor Days. This could be due to the point in the cycle relative to monetary or fiscal policy or expectations around growth in specific years.

There are, of course, stand-out cases where relative outperformance is beyond doubt. Santander in January 2023, Danske in May 2023 and Barclays in January 2024 all went on to enjoy high single digit or even double digit outperformance relative to their index in the period immediately after their event and built further on that over the following 6 months. While it is still early days, ABN Amro looks to be the standout in terms of relative share price immediately after their event from November/December 2025 vintage, although by year end it had largely given back that outperformance relative to the sector.

Focussing on Banks: The cycle is all important. How have Investor Day targets changed over time?

Switching our focus to just the bank sector, classically at a bank investor day, the market will expect to see management communicate on return on equity, efficiency, growth expectations, capital ratios and capital distribution (be that dividends or share buy backs). While each bank approaches target setting individually, typically, targets are set for a three year period with more granular guidance on expectations for the next 12 months. Sometimes the event is about setting new expectations, sometimes it’s about resetting existing ones.

The significant changes in the financial and economic backdrop over the past decade has, inevitably, impacted the targets that banks set at Investor Days. Over the last three years, the key issues have undoubtedly been the impact of interest rates on profitability and the distribution of free cash flow following the end of a long journey to stabilise and rebuild capital levels.

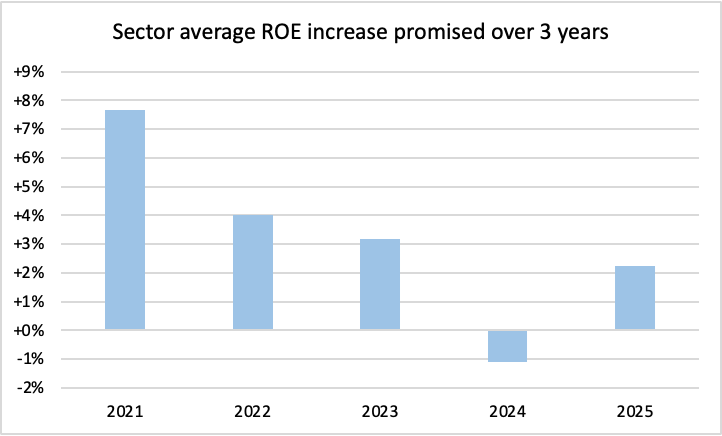

As the period of mean reversion nears an end, and many banks trade at multiples above tangible book value, the market is now looking forward to a period of higher profitability, continued strong free cash flow generation but importantly also franchise growth. We have analysed the evolution of 3 specific factors over the period which demonstrate the scale of change since 2021 and are likely to be crucial future target setting:

- ROE expectations: Interest rate changes have meaningfully impacted expectations for future profitability. Whereas five years ago the challenge for most banks was dealing with an apparently ‘lower forever’ rate environment, over the past 3 years those expectations have been transformed

- Higher starting profitability: For most banks profitability levels were very low before 2022. As a result, almost all banks holding Investor Days over this period were promising a meaningful improvement in ROE. With profitability now improved, the ROE commitment is no longer a ‘bottom left to top right’ chart. That also has implications for cost and cost income ratio commitments

- Capital: Finally, post the 2008 financial crisis and the resulting re-regulation, most banks were focused on driving capital ratios ever higher. As a result, many found themselves in a position of surplus capital and Investor Days typically became the opportunity to commit to lower capital ratios in the future. As those starting capital ratios have in turn now come down, so the commitment to future reductions in capital ratios has similarly become smaller.

We address each of these trends in the following pages, starting with ROE forecasts.

1. Return on Equity Commitments at Investor Days

Over the past 6 years, the promised ROE improvements at Investor Days has generally become less ambitious, in turn reflecting the higher starting levels of profitability as well as changes in future interest rate expectations. Whereas in 2021 across the sector banks were promising an ROE improvement of almost +8% on average over a 3-year period, by 2025 that had fallen to +2%.

2. Profitability: Cost Commitments at Investor Days

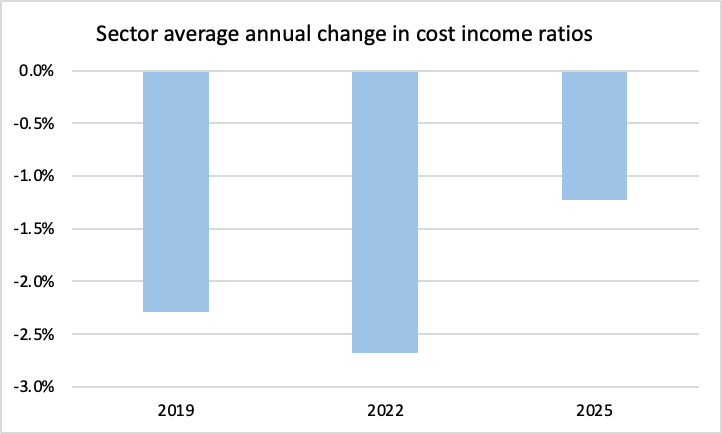

In part reflecting these same trends, the sector’s commitment for cost income ratio improvements has similarly become less ambitious. Back in 2019, banks holding Investor Days on average were promising over 2% per annum improvement in their cost income ratio; for banks holding Investor Days in 2025, that pace of improvement had fallen to just over 1%.

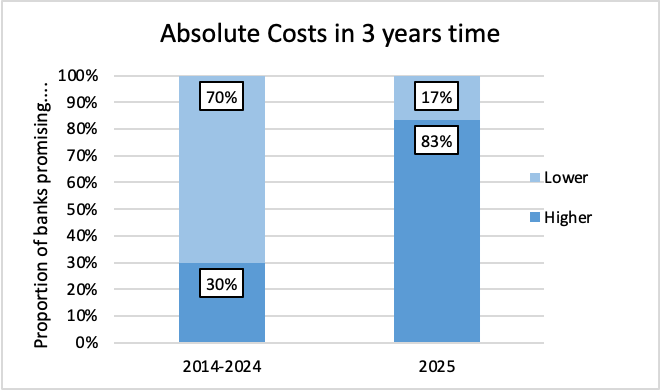

One other feature of note relates to the use of absolute cost commitments. Reflecting the more subdued revenue environment, in the decade to 2024, 70% of banks who held Investor Days were committing to lower absolute costs in 3 years’ time relative to their most recently reported level. In 2025, that proportion had fallen to less than one fifth, with the stronger revenue environment – combined with increasing IT costs (specifically AI related) – meaning most banks are only offering cost income ratio targets and either expecting costs to rise and/or not committing to an absolute cost level.

It will be particularly interesting to see what cost commitments emerge in 2026. The raft of Investor Days in November 2025 focused heavily on the benefits of AI and process transformation. Although absolute cost targets are now less prevalent, a number of banks are targeting an acceleration in income growth and expect to hold costs relatively flat in the coming years, particularly in the personal banking arena which might suggest a break in this trend.

3. Capital ratios: Commitments at Investor Days

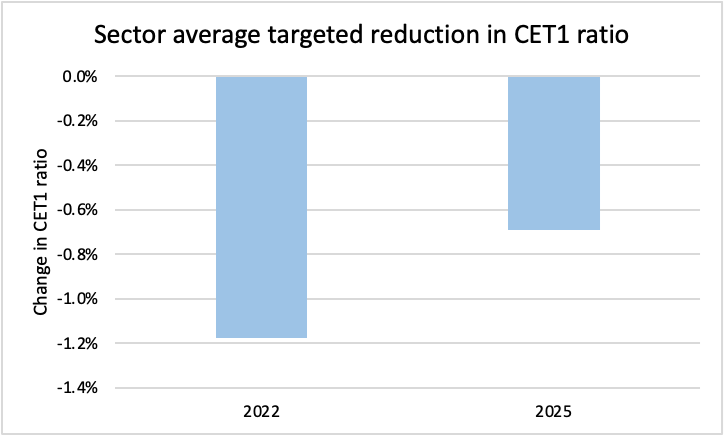

As noted, the post financial crisis re-regulation meant that it was clear that banks entered the early 2020s with surplus capital. As a result, an important feature of those early 2020s Investor Days was the commitment to reduce capital ratios. As shown below, in 2022 on average banks holding Investor Days committed to more than a 1% reduction in their CET1 ratios. As those capital ratios have started to come down, and as other uses of capital have become more important (e.g. faster RWA formation, M&A) so the commitment to reduce capital ratios from current levels has nearly halved.

Motivations for hosting an Investor Day

The near-term share price performance is of course only one measure of success. If share price outperformance relative to the sector following an Investor Day is so hard to achieve, why are these events so popular? Why bother hosting an Investor Day?

We believe that it is vital for a management team to be clear on their motivations and objectives for an update and to evaluate a full range of options, rather than simply copy and paste from previous iterations, if they are to have the maximum chance of delivering a successful event.

Given that clarity of objective is so important, we have observed 6, very different, motivations for hosting such events:

-

- CEO change and outlining new priorities. Generally when a new CEO is appointed market participants allow a grace period to review a group’s operations and form their own views on areas for strategic change. An Investor Day often represents the favoured format for presenting the results of this in-depth strategic review.

- Resetting the Equity Story to attract new investors. This is often considered the overarching output from an Investor Day. Typically regular results are reviewed by sell-side analysts and some buy-side analysts. If a corporate wants to ensure the attention and attendance of more buy-side generalists, an Investor Day is the preferred way to go.

- Unveiling or restating medium term financial targets. Increasingly financial companies are setting medium term targets against which they wish to be evaluated. These targets will be expected to be based upon a bottom-up detailed financial plan. An Investor Day presents an ideal opportunity to reset the time horizon more to the medium term and explain in more detail the building blocks of those high-level financial objectives. Sometimes these are standalone events, sometimes they accompany a regular presentation of financial results.

- Shelf-life document detailing the equity story. Often this is the most popular motivation. Once upon a time annual reports were the go-to documents to read everything that one needed to know about a company’s strategy and performance. However, with the explosion in financial disclosures many consider these no longer fit for such a purpose. An alternative source material used to be a sell-side analyst initiation of coverage but post MIFID II these have become few and far between. An Investor Day may now be considered the best means of creating a ‘go to strategy document’, detailing everything that a company stands for and wishes to be judged by. Such a document should aim for a shelf-life of the duration of the plan presented and be the accessible reference document to attract new investors.

- Galvanize divisional management around targets and hold their feet to the fire. As Jamie Dimon said in a recent Letter to Shareholders, “it is also important to have the proper segments reported externally ……properly accounted for and generally aligned to their relevant competitors. This actually helps hold managers accountable by forcing them to accurately assess performance — the good, the bad and the ugly”. In preparing for an Investor Day divisional management are likely to be required to communicate in much greater depth their relative strategic positioning and what is achievable. Those divisional managers are then asked to stand up in front of a group of investors and commit to those targets which makes them far more accountable, may increase the likelihood of delivery, and share the jeopardy for non-delivery. This also represents and efficient way to introduce key executives to the investment community without detracting from their day to day focus on business performance and delivery.

- M&A activity. If meaningful M&A is undertaken which results in a change in the profile of an organisation, it is common to hold an Investor Day to profile the new business, to introduce new management teams and to detail, or enhance understanding of, how synergy targets will be achieved.

So what are the learning points?

- Investor engagement is key rather than short term price reaction

With such a wide range of motivations for holding an Investor Day it is clear that a ‘one size fit all’ approach is unlikely to be effective. It is also perhaps not unsurprising that using share price performance as a measure of success is unlikely to be an effective prime objective. Rather, share price performance should reflect a clearly articulated, well executed and consistently delivered strategy over time. An Investor Day represents just one, albeit a very effective, component of successful investor engagement. Success should be measured instead by how much additional investor interaction it stimulates over, say, the following year.

- Listen to investor concerns

There is a temptation for management bias to the positive. Investors all too often are told the story that XYZ financial is great and if they implement their plans they are going to be even better. In contrast investor concerns on a particular issue may be left unaddressed like the proverbial elephant in the room.

Management would be well served taking time to understand in advance of an event what it is that is holding back appreciation of the equity story. A perception study or outreach exercise conducted several months in advance of an Investor Day is one means of testing the water of what it is investors would like to see addressed and helping ensure their views are heard.

- Differentiation is key

For banks in particular, 2025 saw massive share price performance dispersion, with the best performers up 150% and the weakest performers essentially flat. It is no longer sufficient to rely on a rising tide of higher rates or capital distributions to lift all boats. At the end of 2025, there is an increasingly wide range of current ROEs, valuation multiples and expected growth rates across the sector. Investors face complex choices about the continued strength of the rally, sustainable levels of profitability and the drivers of prospective returns.

It is likely that differential performance between the winners and losers will again be significant in 2026 with those stocks most clearly articulating their equity stories having the greatest chance of outperformance.

- A bespoke and calibrated format

There is no single approach to shape an Investor Day. Management need to address distinct audiences – short -term trading funds, sell side analysts, buy side sector specialists and buy side generalists in the long-term investment community. Each has different time horizons and priorities.

Increasingly investors are looking for shorter events (2-3 hours rather than a full day) with virtual and physical attendance options, supported by a full range of online materials – slides, transcripts and Q&A responses. It’s also the case that investors are beginning to use AI engines to compare and contrast the published materials.

Increasingly it is not just about the event, but about the deck of materials that can then be used for investor roadshows and the follow on interest that those conversations drive.

What next? Some key questions

Many financials have used similar constructs for target setting over the last 5 or 6 years and in some cases are on the second or third iteration of Investor Days using the same range of targets.

As views of the sector have become much more positive over the last two years can management teams rely on the same framework with modified target ranges or is a more fundamental re-think likely to be needed?

- Be cognisant of point in the cycle

Perhaps there is a learning point about where we are currently at in the cycle at end of 2025. Banks in particular have enjoyed huge uplifts in their profitability due to higher rates with practically no increase in credit provisioning. As a result they are finally delivering ROEs of low to mid teens, in excess of their cost of capital.

What targets and metrics will investors use to assess the next stage of the cycle? How do these compare to the existing suite of targets? Is it wise to continue to increase ROE targets?

- From mean reversion to Growth

With the majority of the sector earning a double digit ROE and many financials now trading above Book Value, management teams increasingly have a mandate to ‘grow the company’.

What will this mean for distributions (Dividends and Buybacks) and future focus? Will EPS targets, net profit or jaws become a key part of the target regime?

- New news? Extending or Reinventing?

Our review of how targets have changed through the cycle illustrates that three year plans have served the sector well while it has been out of favour, allowing management teams to signal progress towards normalised returns. It also shows how targets have been extended and that in some cases current levels of profitability may be above the most recently committed medium term targets.

With investors now accepting these targets and are looking for signs of superior profitability or growth how should management teams seek to frame expectations? Is there new news? Are existing targets extended or does the framework need to be reinvented?

- Is AI a game changer?

It remains to be seen whether the AI revolution can deliver volume and revenue growth with practically no increase in the expense base. A number of banks are beginning to outline this kind of pathway. Can they deliver? Will investors buy into this story?

Investors want to see evidence of compelling AI and technology driven process improvement but, if the results of the November/December Investor Days are any judge, the market is cynical. As a generalisation, investors took the improved ROEs as sustainable and as a given , and expect that they can be further improved to even high teens ROEs. However, the more cynical questioning is whether revenue growth can be achieved without significant new investment, or without an increase in provisions. This circle is yet to be squared and will be an integral part of all investor scrutiny in 2026 and beyond.

Will there be winners and losers from AI deployment and process transformation or will there be a sector wide tailwind from process improvement?

Recent Comments