The Q&A trends you really need to know…

For Financials the Q1 2023 reporting season seemed to stumble from one troubled name to the next whilst managing to avoid outright contagion. The challenges facing several US banking names were most acute with the regional banking index falling over 50% peak to trough. Structural differences between the US and European Banks – less real estate exposure and greater recognition of mark-to-market losses on bonds – were observed in the much milder sell-off of European banks in March. Indeed, the average European bank is up nearly 9% year to date. However, on both sides of the Atlantic there was a concentration of investor fears around deposit flight, peak net interest margins and whether there are any signs yet of rising delinquencies.

At Q1 we, the partners at Veritum, have performed our usual analysis of questions asked of financial management teams which we believe is an invaluable barometer of what’s keeping analysts and investors up at night. For the past 3 years we have burnt the midnight oil diligently wading through c.1400 questions per quarter asked of the top 120 US and European financial services managements. In doing so our main interest is helping our retained clients prepare for their own analyst and investor questions. But we also get a lens on trends for the sector as a whole.

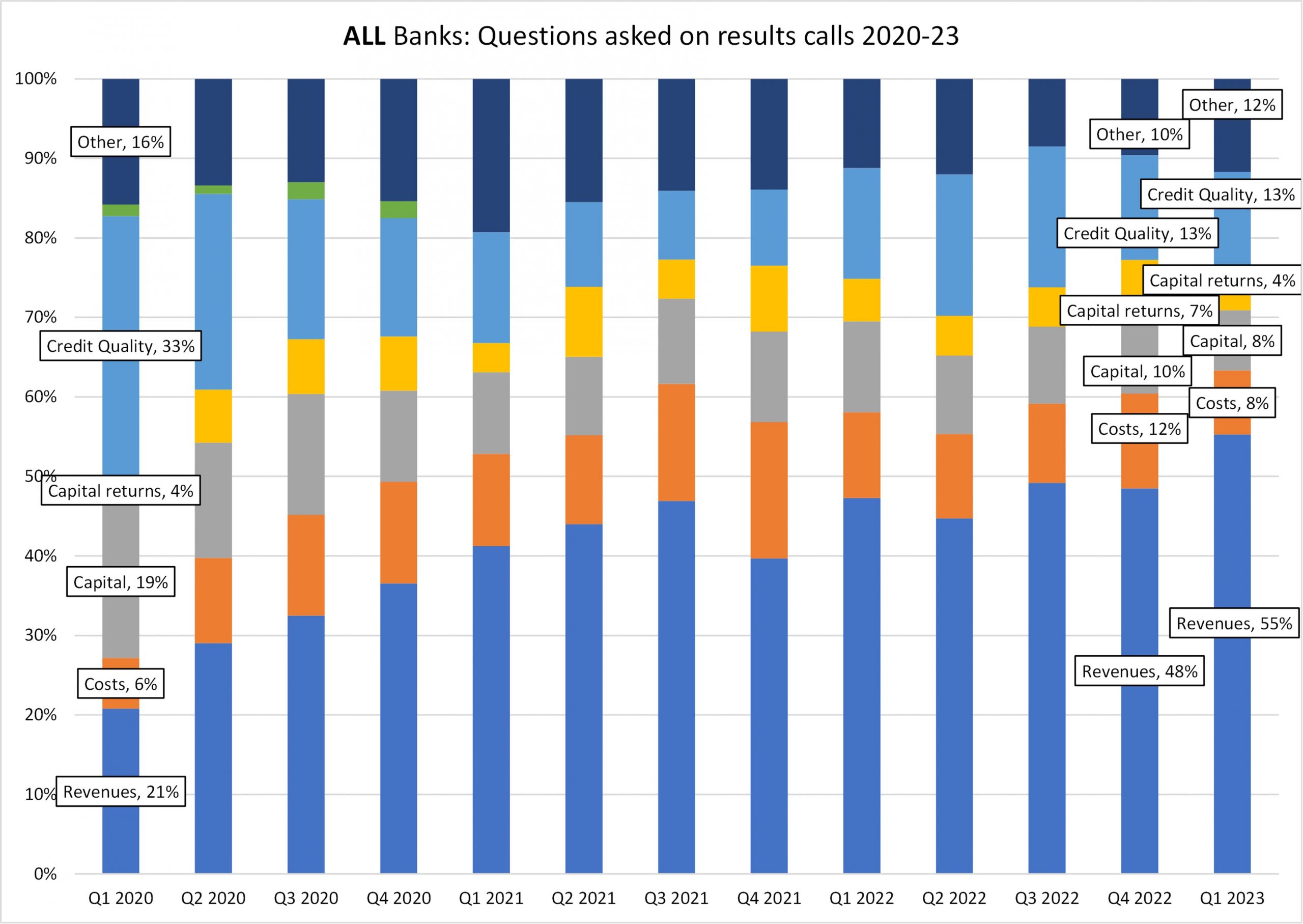

At an aggregate level the concentration of revenue questions reached an all-time-high of 55% of total with slightly less focus on costs.

Deposit shift and peak NIM concerns dominate

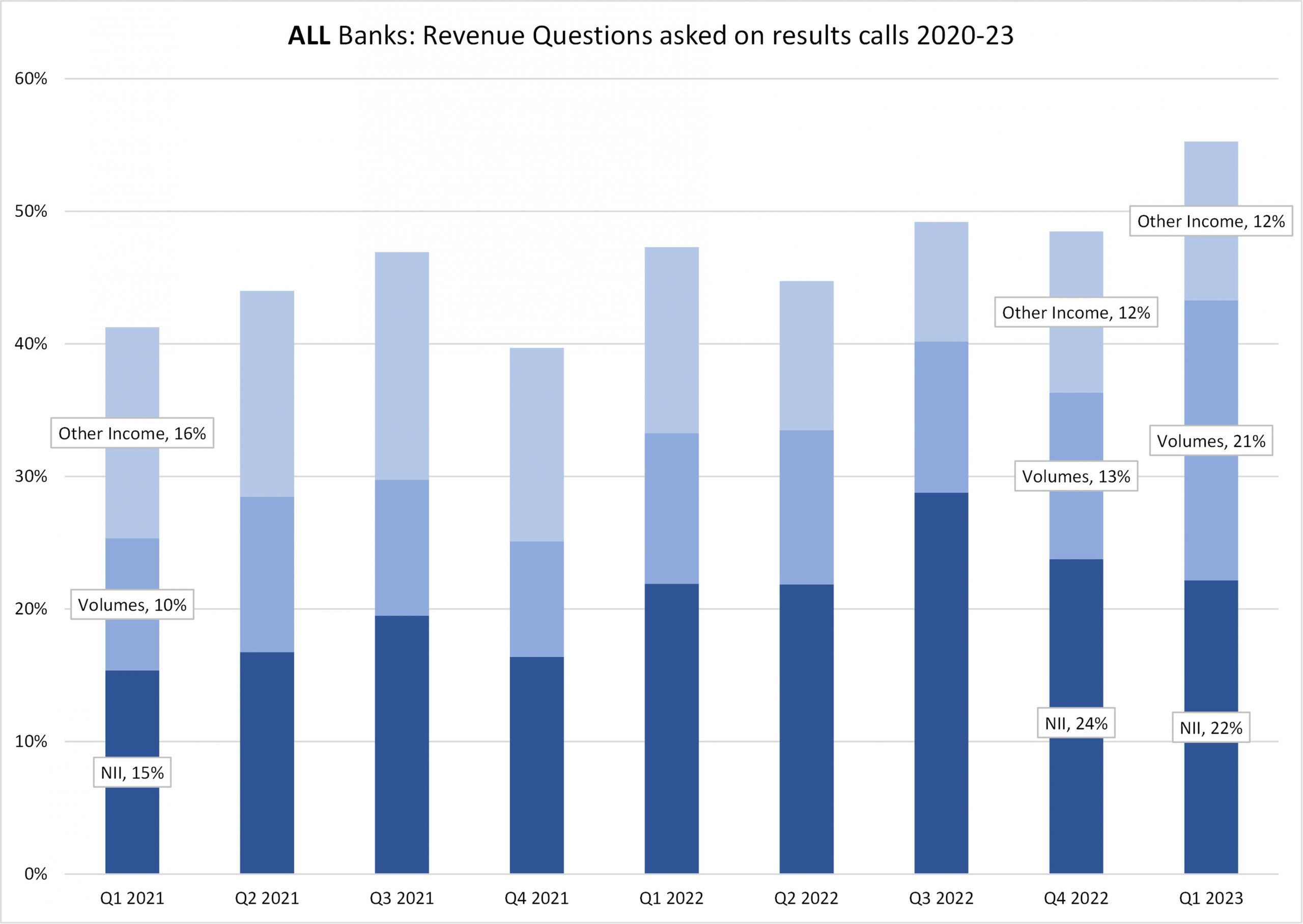

But what is more interesting is the breakdown of which specific areas of revenues were in focus at Q1. In both the US and Europe there was a clear shift among analysts and investors asking more volume-related questions, chiefly concerns around deposit shift from weaker to stronger institutions or fears of liquidity mismanagement. In 2021/2022 the proportion of volume-related revenue questions was pretty constant at 9-11% of total. At Q1 2023 this roughly doubled to 21%. For just the US banks, it was the focus of almost one in four questions asked of management.

In contrast there is evidence that questioning around net interest margins peaked at Q3 2022 and continues to fall quarter-on-quarter. This likely reflects concerns that central banks will pause the speed of rate rises, despite stubbornly high inflation, and that, due to competitive and regulatory oversight, more of the benefits are now passed on to depositors.

Credit quality-related focus did not really change at Q1 and still appears low at only 13% of total questions asked, remaining some way below the pandemic peak of Q1/Q2 2020, although there are differences by region. Within this area there is a rising focus on commercial real estate being the first area to show signs of stress.

Further detail by geography

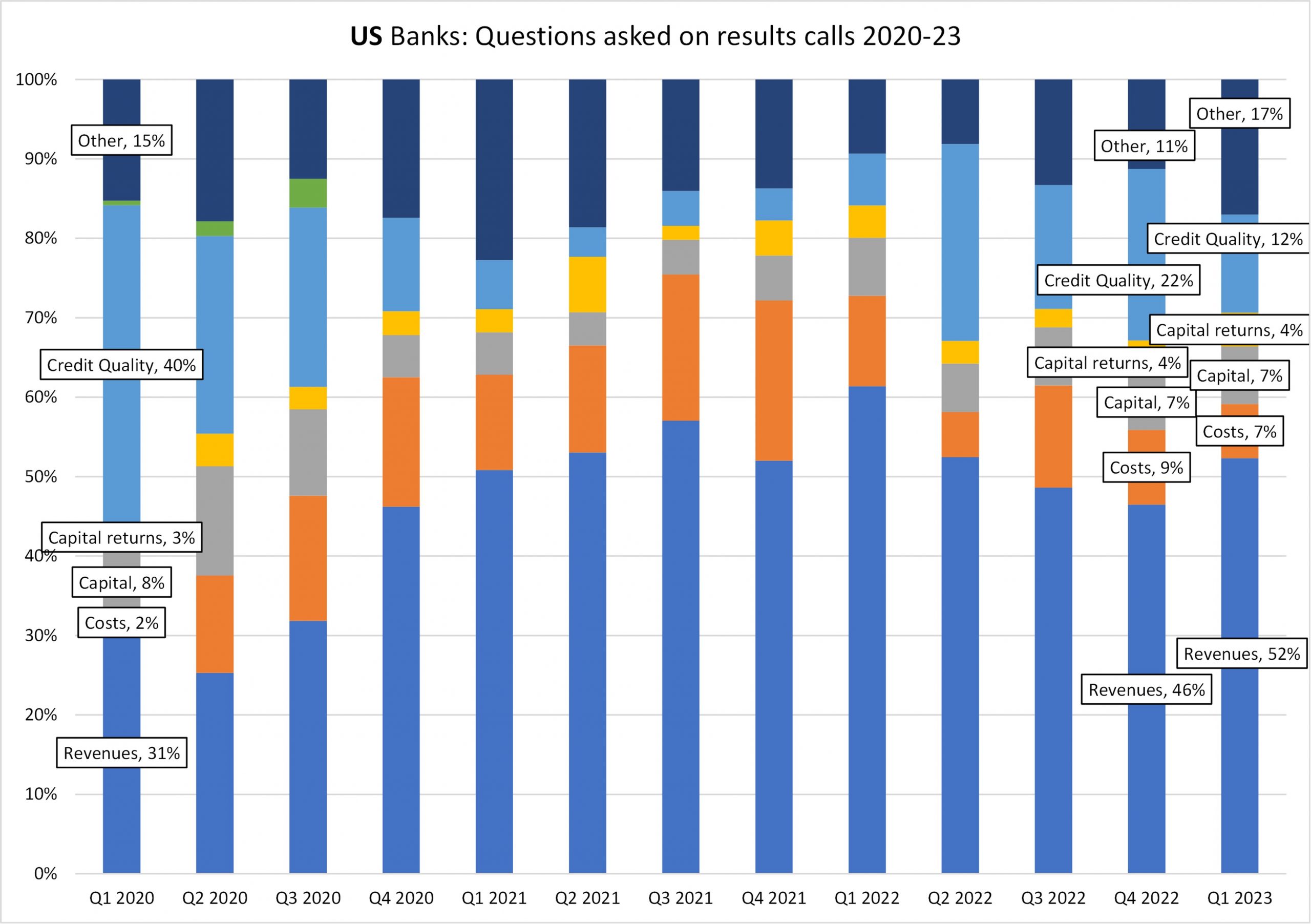

US Banks

The clearest trend at the US banks at Q1 2023 was a large reduction in questions relating to credit quality with a significant shift towards revenues and more specifically volume-related themes. At nearly a quarter of all questions asked of US management the proportion of volume-related revenue questions set a new high. These trends reflect the fact that the US regional names which have got into trouble in 2023 have been largely driven by deposit flight and liquidity mismanagement issues, not any surge in loan charge-offs. Despite US regulators stepping in to guarantee more US depositors, the stronger US banking names reported attracting a surge of new deposits.

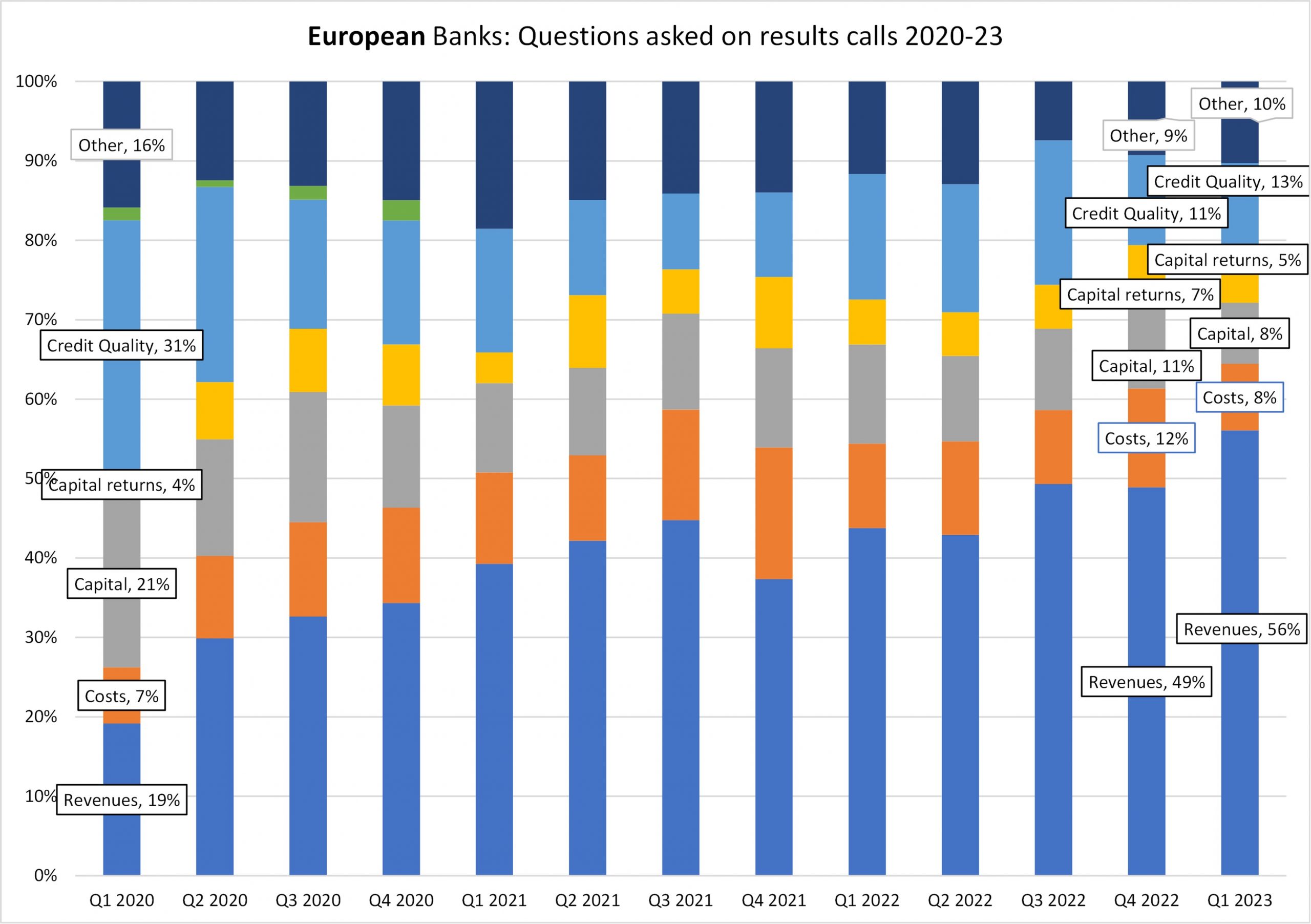

Europe

Across the European banks, questions around revenue trends similarly experienced a strong increase to a new high of 56% of total but this time at the expense of fewer questions on capital, capital returns and costs. The breakdown of the revenue component revealed the same trends of volume-related questioning surging to a new high of 21% of total and NII-related questioning falling from its Q3 2022 peak. The proportion of credit quality questions rose here quarter-on-quarter to 13% of total. NPL formation trends are slowly rising but not yet showing any significant surge and historic provision stock built up in the pandemic years still seems adequate for now

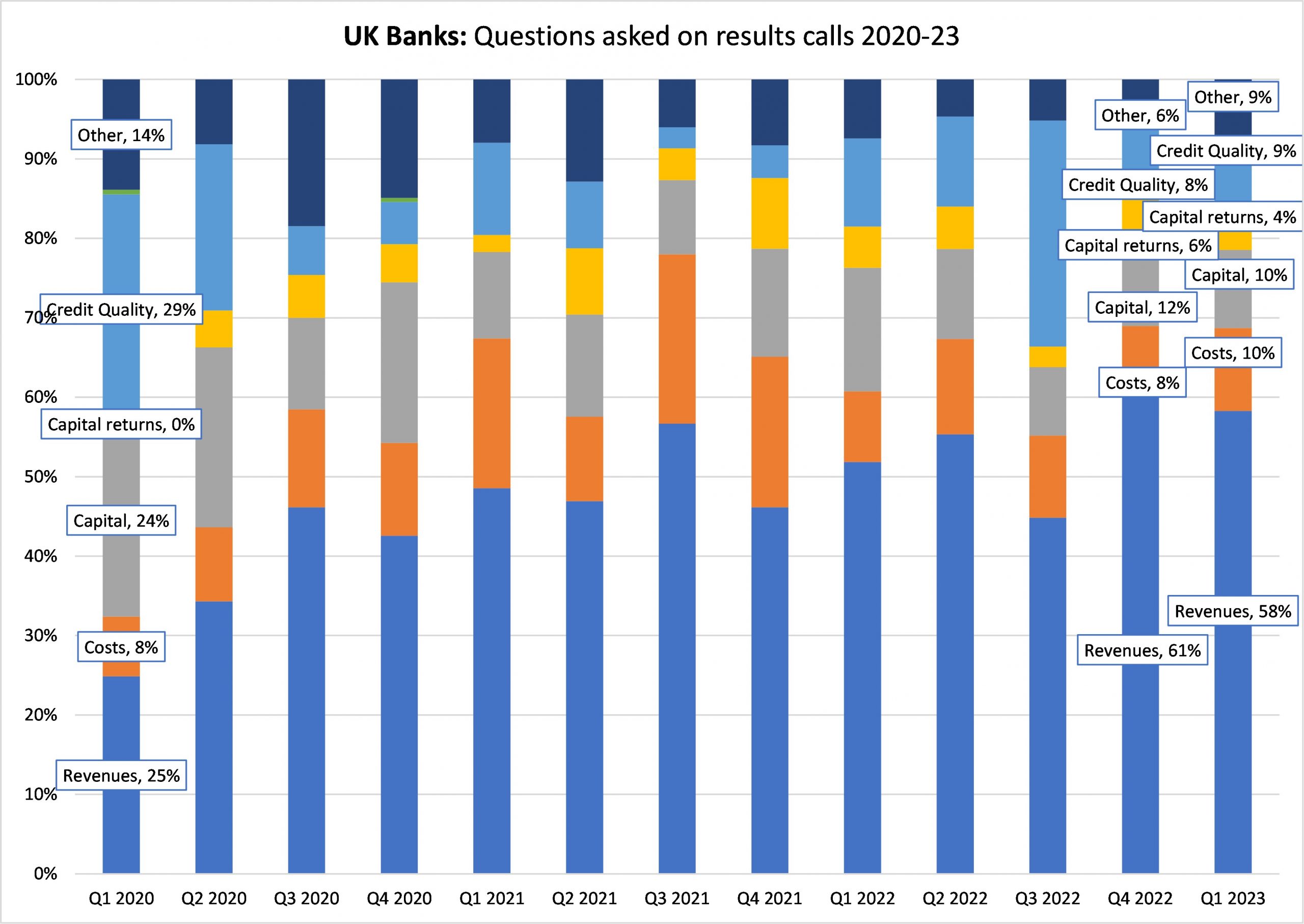

UK

The UK again appears slightly in contrast to other geographies with the proportion of revenue-related questions falling slightly quarter on quarter, but still at an elevated level of 58%. Within the revenue category, the observed trends are the same of NII questions falling and volume-related rising. But for the UK there does seem to be a trend of increased questioning on costs. This could well reflect UK inflation remaining stubbornly high despite rate rises and concerns this endures, together with known pressures in the labour market. Capital and capital returns seem to be momentarily out of focus despite buyback programs continuing for certain names and even a quarterly dividend for HSBC.

Recent Comments