The Q&A trends you really need to know…

When research analysts hog the mic. and ask their usual ‘3 unrelated questions’ at a company’s quarterly results we believe they reveal far more than they actually intend to. In fact we at Veritum contend that an analysis of quarterly Q&A trends is an invaluable barometer of what’s keeping analysts and investors up at night. Investors relations teams and CFOs who heed these emerging trends can better prepare their presentation materials and Q&A responses to help allay such fears.

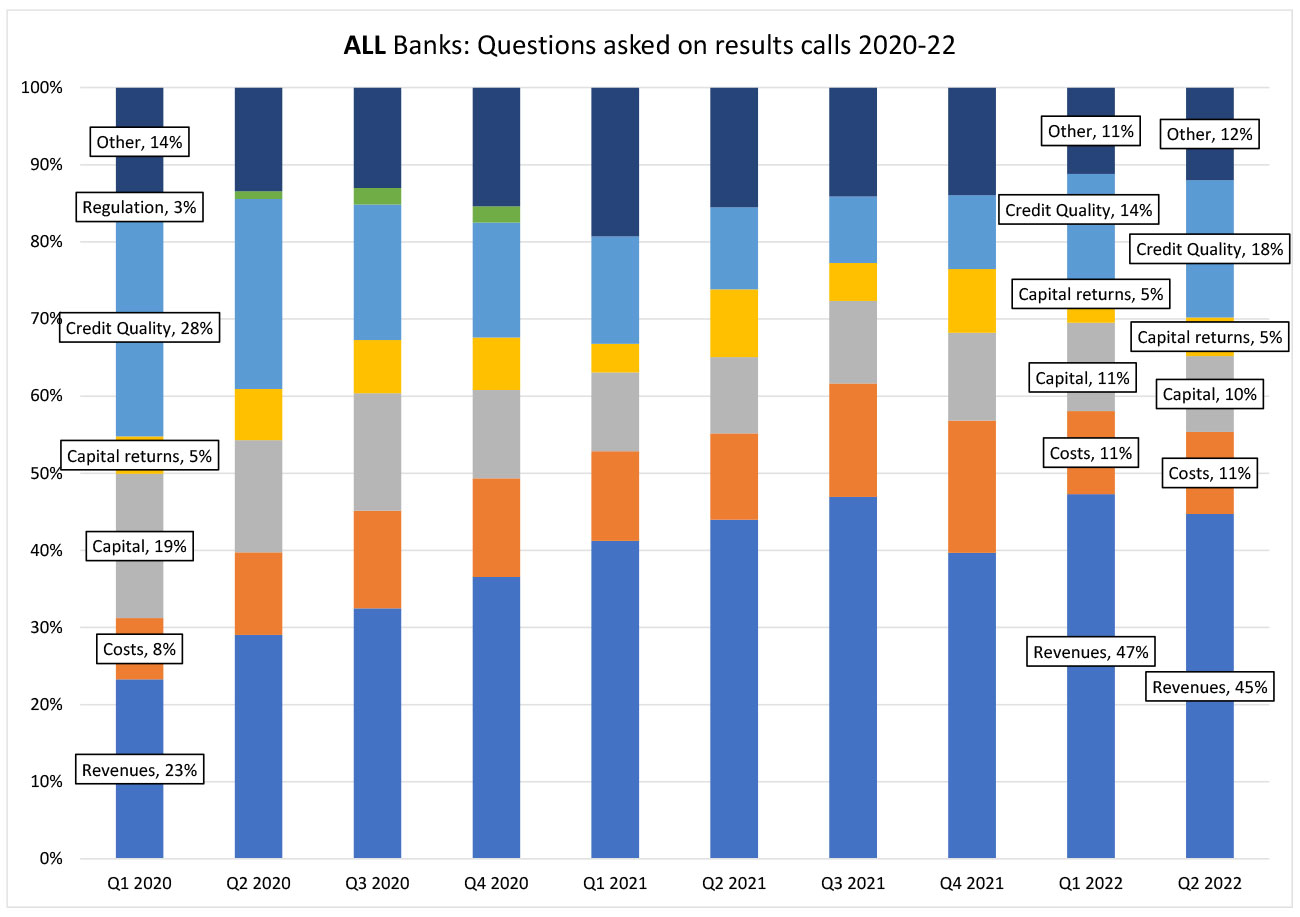

For the past 3 years we, the partners at Veritum, have trawled through c.1400 questions per quarter asked of the top 120 US and European financial services management teams to observe changing areas of concern or focus. In doing so our main interest is helping our retained clients prepare for what’s on the way. But we also get a lens on trends for the sector as a whole.

With the Q2 2022 reporting season now finally drawing to a close, we publish the high level summary conclusions from this analysis.

Obviously it’s all about the revenues

At a banking industry level, the proportion of questions around revenue outlook is close to record levels at 45% of total. This is most specifically on net interest income, interest rate sensitivity and the fraught topic of deposit beta. Analysts are keen to understand better banks’ exposure to rising rates, and within that to determine the actual and prospective extent of pass-through of the benefits of rate rises to customers. Many banks have resisted giving clarity on their actual experience, leading to a presumption that pass-through has been close to zero, or giving any directive guidance on the future. However, most have now given some sensitivities that can help analysts make their own judgement calls.

As would be expected at this point in the cycle the proportion of questions around credit quality has risen dramatically, albeit not yet back to the pandemic peak of Q1/Q2 2020. There are clear differences by geography, with the US banks recording a strong increase to 25% of total questions relating to impairments or credit quality more generally. Europe was a mixed bag, but for the UK concerns may be a little more lagging with the proportion unmoved at 11% of total.

Inflationary expectations and the cost-of-living crisis do not yet seem to be driving up the proportion of questions around cost base at 11% of total. This is perhaps the result of financial services companies’ expense bases not having a significant energy-related component and perhaps lower pressures vs other industries currently on talent pool.

In contrast to the pandemic period, banks appear committed to paying dividends and returning capital to varying degrees via buybacks. Capital levels appear to be viewed as adequate or overcapitalised in aggregate. As a result, the proportion of questioning around the capital base and capital return areas remains relatively unchanged Q2 vs Q1 2022.

Further detail by geography

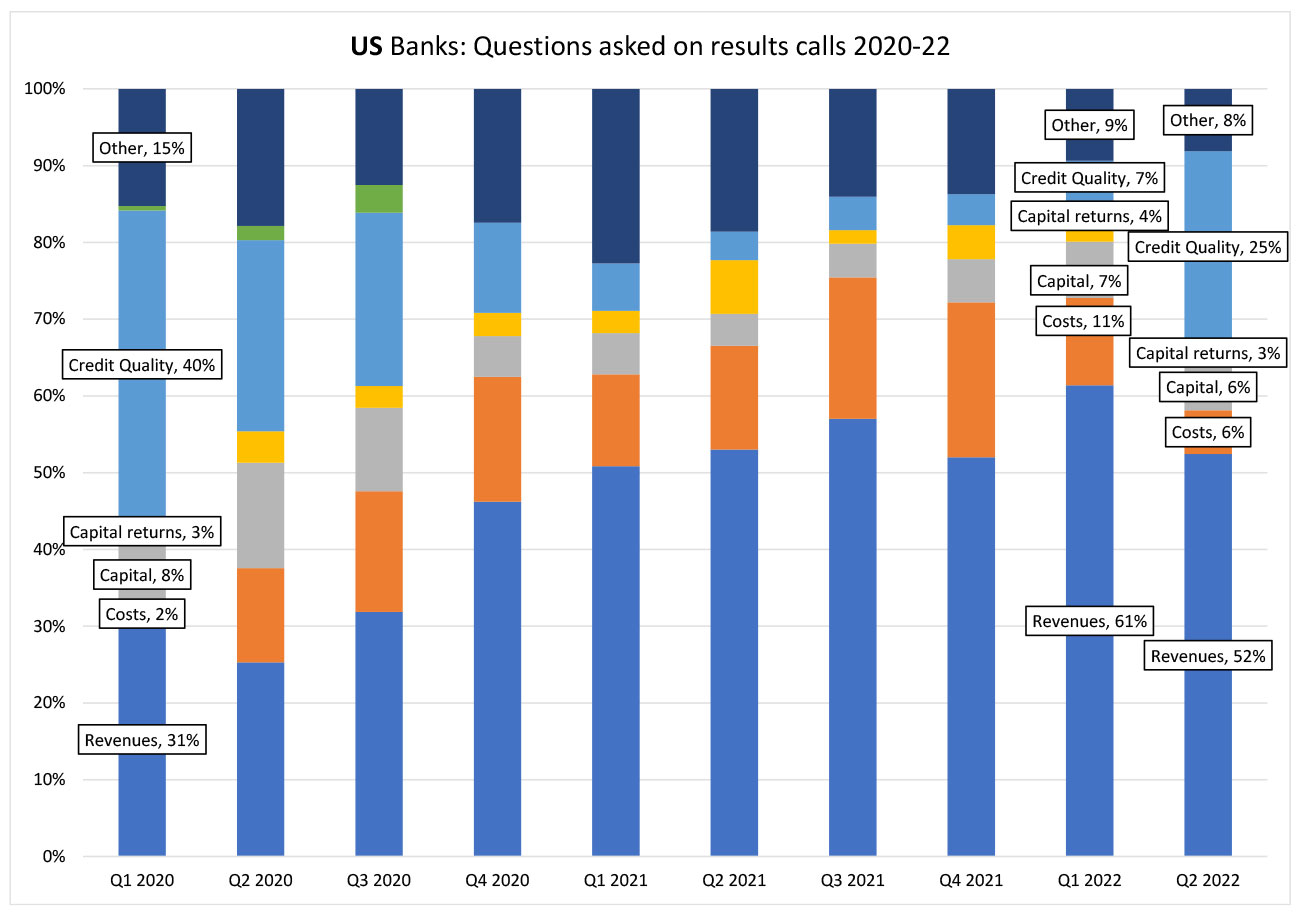

US Banks

It may be a product of earlier reporting dates for US banks, or the still relatively new CECL accounting regime, which caused a large spike in the proportion of questions around credit quality at Q2. Such questions accounted for 25% of the total this quarter, up from only 7% of the total for the prior quarter. The questions are very much focused on forward expectations since the actual incidence of delinquencies remains minor to date. The proportion of questions focusing on revenues and revenue outlook hovers near all time highs at 52% of total, but questions on costs still remain in the minority, down to only 6% of total.

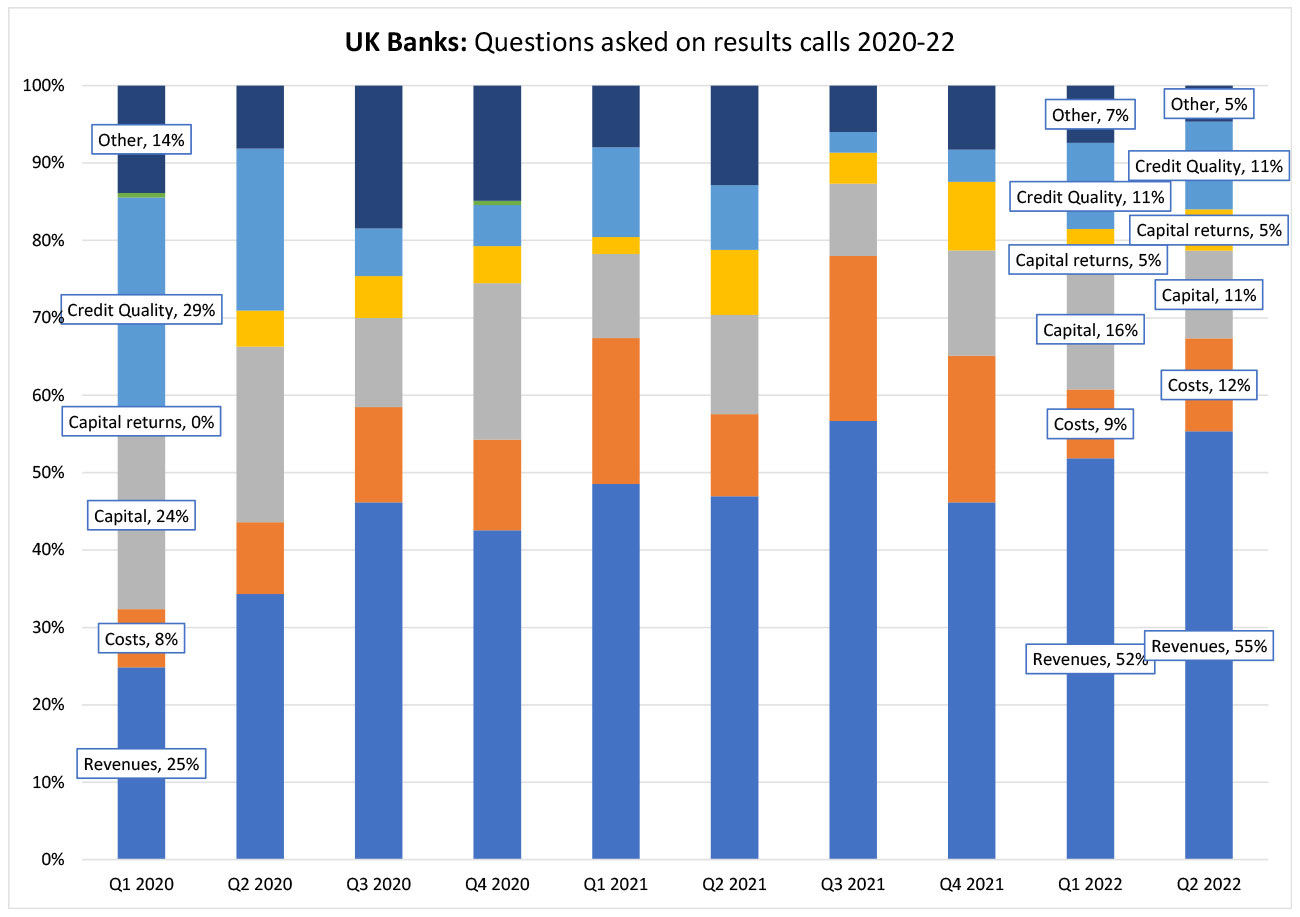

UK

UK bank analysts remain fixated on revenue trends at 55% of total questions posed. This is most specifically on NII, interest rate sensitivity and deposit betas. Analysts are trying to determine which banks benefit most from rising rates, and within that to understand prospective pass-through of the benefits to depositors. A developing angle on this is that analysts have moved on to asking whether higher profits from deposit-taking could lead to windfall taxes or reductions in revenues from central bank deposits. In other areas, there was a reduction in the proportion of questions focused on capital to 11% of total at Q2 from 16% at Q1 and the proportion relating to costs rose slightly to 12%.

Recent Comments