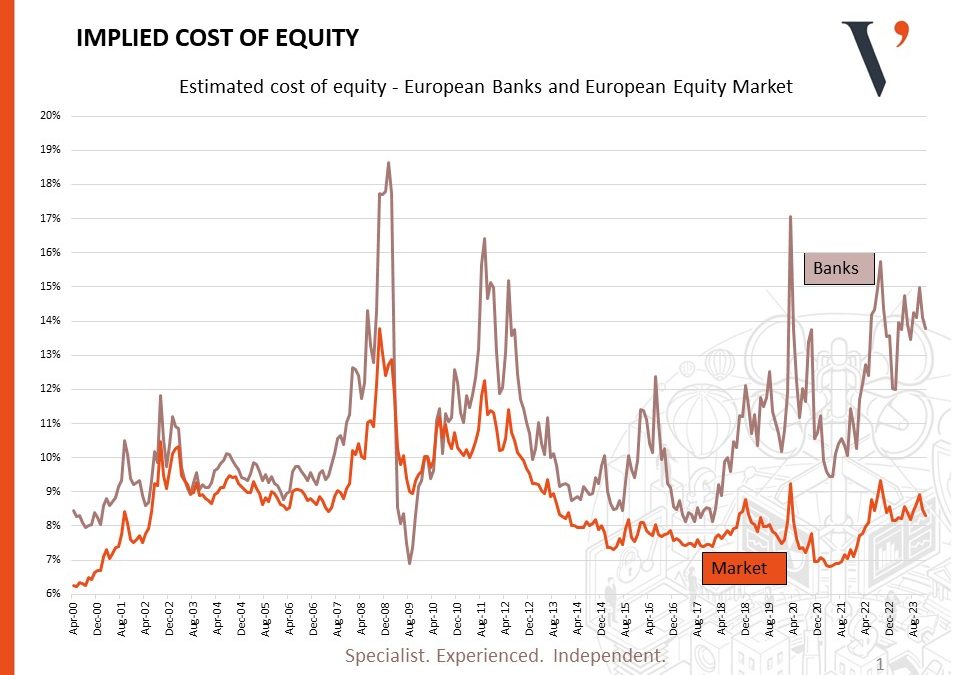

At the Morgan Stanley financials conference 6 years ago investors were polled on where they thought the cost of equity for European banks would be at the end of that year. Not a single investor at the time said above 11%. Yet at the same conference earlier this month, over two thirds of investors polled said they now expected it to be above 11%. What has happened to cause such a dramatic reassessment of the cost of equity for banks by investors?

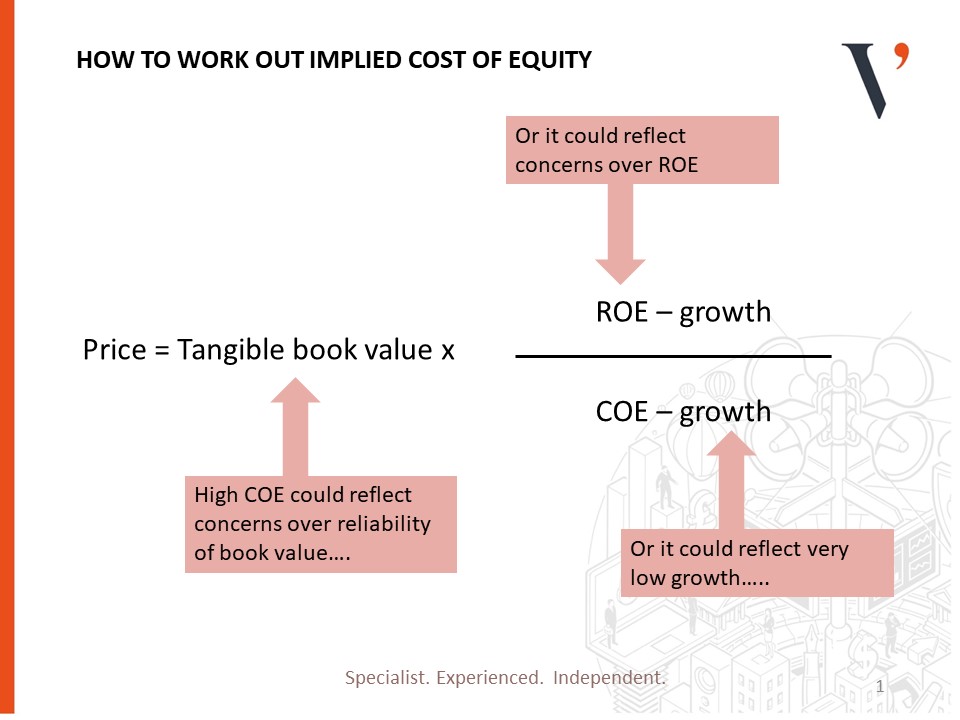

At a recent speech on this topic, Veritum Founding Partner Simon Samuels tried to break the issue down into external factors, which are largely outside of banks’ control, and internal and communication factors which are to varying degrees within banks’ control. And this analysis was done through a framework of thinking about how each factor might impact the book value, the growth rate or the sustainable ROE of the bank, and hence its impact on the implied cost of equity.

If you would like to discuss more, please contact info@veritumpartners.com.

© 2023 Veritum Partners

Recent Comments