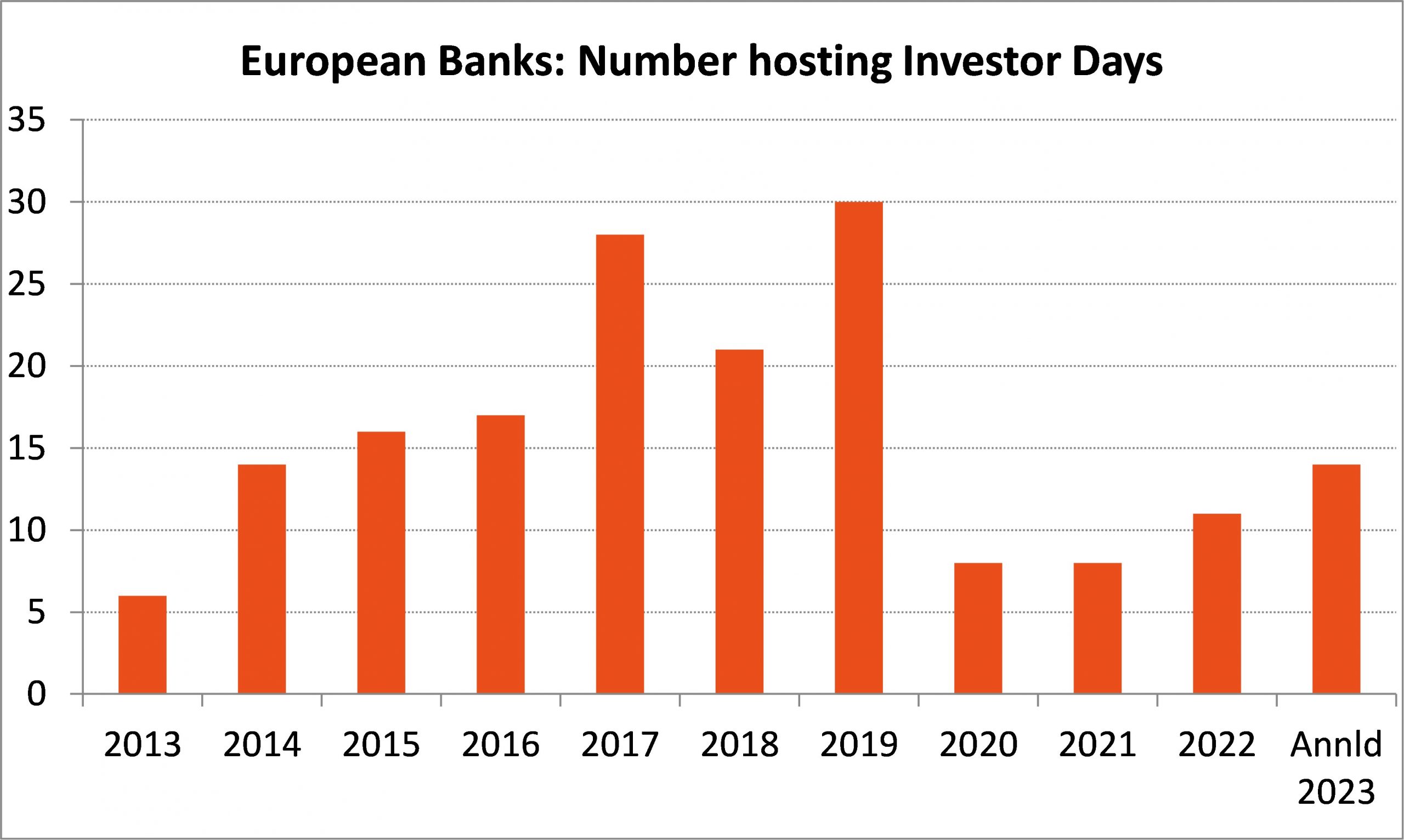

The popularity of Investor Days for Financial Services Companies is on the rise once more. There was a lull during Covid but in early June 2023 three European banks hosted such events and the total number for 2023 looks set to be up strongly year on year. An analysis of share price data suggests that the majority of financials hosting such events outperform in the month prior to delivery but roughly 50% underperform in the 6 months thereafter. Given the large amount of resourcing that goes into such events, an observer might be entitled to ask what is the point? Why are these events rising in popularity and more specifically what can be done to make sure that the host is in the 50% which get rewarded for their efforts?

There is often a debate between whether to host round-table strategy updates, focusing on one specific division or area of concern, or a more holistic Investor or Capital Markets Day. For the avoidance of doubt, we have focused exclusively on the latter and analysed the performance of 238 of such events for European and US Banks and European Diversified Financials over the past decade.

In a typical year between 20 and 25 larger scale Investor Days are undertaken by European financials. This reached peak popularity in 2019 before many were cancelled or postponed during the Covid pandemic. Since 2021 the number of such events has been on the rise once more and 2023 looks set to get much closer to that 10-year average.

Raising the bar of expectations

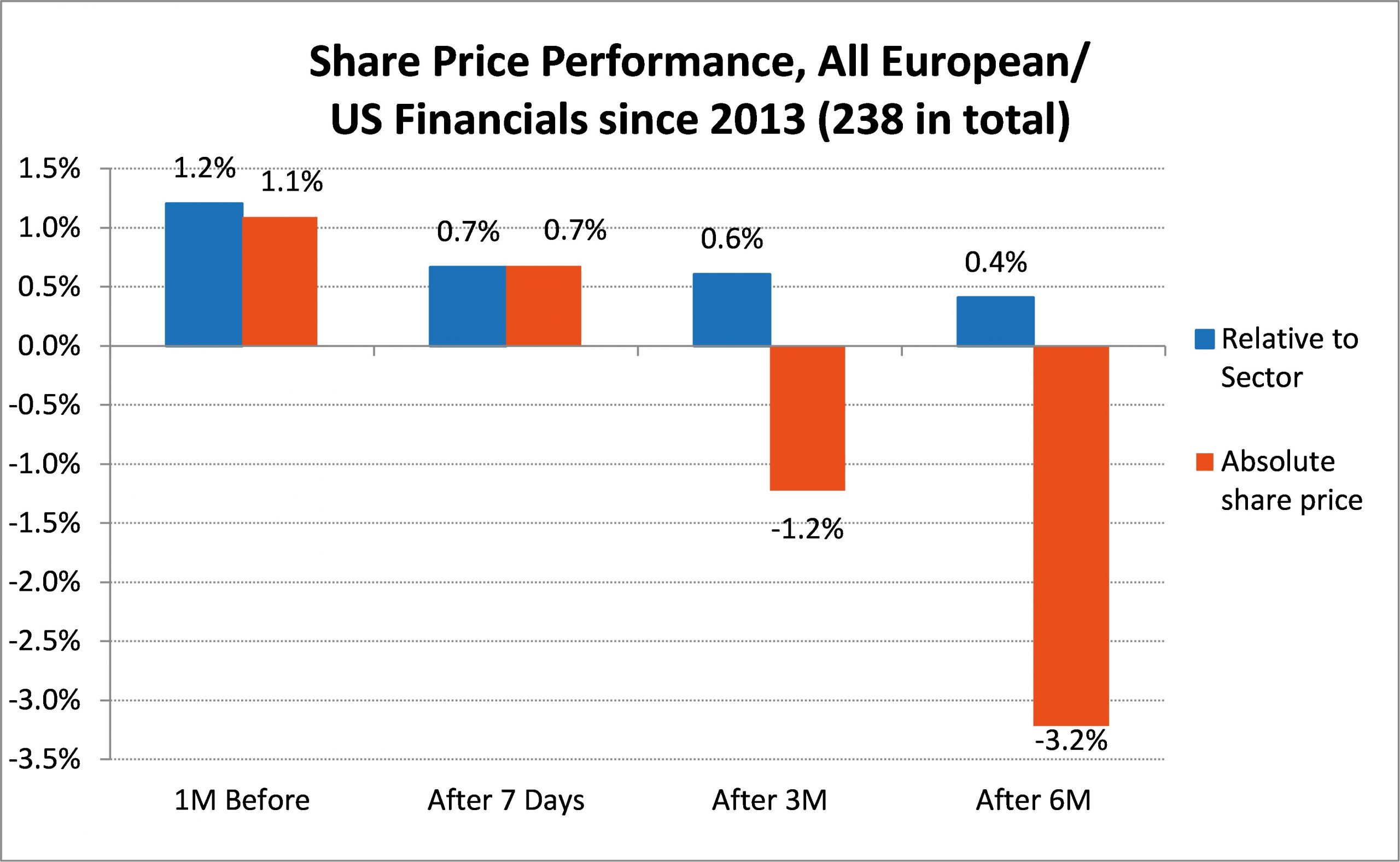

Typically, a management team will announce their intention to host an Investor Day several months in advance and post it on their calendar webpage for all to see. In the month leading up to that announced date nearly 60% of financials outperformed the sector, with an average out-performance of 1.2%. There are a couple of likely explanations. Firstly, the Investor Day is seen as a catalyst event causing generalist investors to take a new look at the equity story. Secondly, the bar of expectations is often raised – after all the company wouldn’t host an event if they didn’t think that they had something new, important and positive to say.

Half go on to underperform

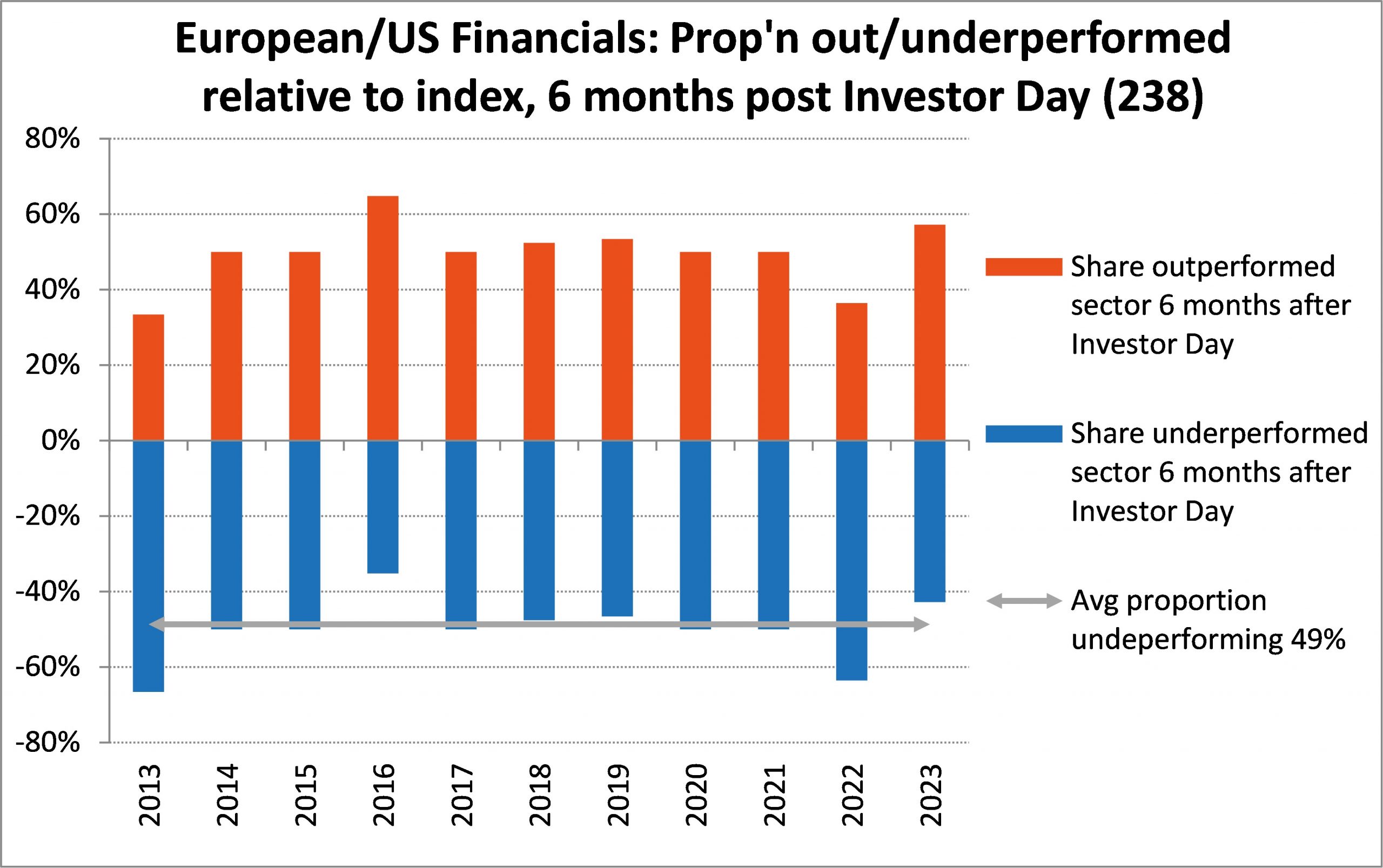

However, often there is disappointment against those raised investor expectations. Whilst share price performance should not be considered the only metric against which to evaluate an Investor Day, if success has to be distilled into one single metric it is probably the one most investors would identify. After 6 months the financial hosting the Investor Day finds that on average their sector outperformance has trailed off closer to zero. In fact over the decade 2013-2023 on average 49% of companies hosting such events underperformed the sector index. 2023 is looking a bit better so far with higher outperformance to date, but 2021 and 2022 were worse than this average.

So why bother with an Investor Day?

If roughly half of all the financials investing significant resources undertaking an Investor Day go on to underperform 6 months later, why bother taking the risk?

The data suggests though more financials are now prepared to take that risk. Obviously these companies hope that they will be in the 50% outperforming post completion. In addition, probably the most respected industry CEO, JP Morgan’s Jamie Dimon, recently opined on this and stated he thinks they are great thing to do. In his April 2023 letter to shareholders Jamie Dimon stated:

“Investor Day is a tremendous amount of work….. while sometimes we get frustrated with investor demands all investors should be treated fairly …..having to explain your business to investors, comparing yourself with competitors and looking at the business as a whole — across sales, marketing, returns, growth, risks and strategic opportunities — was a terrific exercise for us.

It is also important to have the proper segments reported externally ……properly accounted for and generally aligned to their relevant competitors. This actually helps hold managers accountable by forcing them to accurately assess performance — the good, the bad and the ugly”

Motivations for hosting an Investor Day

We believe it is vital for a management team to be clear on their motivations and objectives for an Investor Day to have the maximum chance of ensuring its success.

We identify 4 main motivations for hosting such events including:

-

- CEO change and outlining new priorities. Generally when a new CEO is appointed market participants allow a grace period to review a group’s operations and form their own views on areas for strategic change. An Investor Day often represents the favoured format for presenting the results of this in-depth strategic review.

- Unveiling or restating medium term financial targets. Increasingly financial companies are setting medium term targets against which they wish to be evaluated. These targets will be expected to be based upon a bottom-up detailed financial plan. An Investor Day presents an ideal opportunity to explain in more detail the building blocks of those high-level financial objectives.

- Shelf-life document detailing the equity story. Often this is the most popular motivation. Once upon a time annual reports were the go-to documents to read everything one needed to know about a company’s strategy and performance. However, with the explosion in financial disclosures many consider these no longer fit for such a purpose. An alternative source material used to be a sell-side analyst initiation of coverage but post MIFID II these too have become few and far between. An Investor Day presentation may now be considered a means of creating this go to strategy document, detailing everything a company stands for and wishes to be judged by. Such a document should aim for a shelf-life of the duration of the plan presented and be the accessible reference document to attract new investors.

- Galvanize divisional management around targets and hold their feet to the fire. Jamie Dimon in his shareholder letter specifically references this motivation as key for his organization. In preparing for an Investor Day divisional management are likely to be required to assess in much greater depth their relative strategic positioning and what is achievable. Those divisional managers are then asked to stand up in front of a group of investors and commit to those targets which makes them far accountable, may increase the likelihood of delivery, and share the jeopardy for non-delivery. A management team presenting targets at an Investor Day feels their feet are closer to the fire.

Try to attract new investors. This may be considered more the overarching output from an Investor Day. Typically regular results are reviewed by sell-side analysts and some buy-side analysts. If a corporate wants to ensure the attention and attendance of more buy-side generalists, hosting an Investor Day is the preferred way to go.

Which format is best?

A management team may debate the best format to present more of their equity story and this may take the choice between a round-table strategy update vs a larger scale full Investor Day. Naturally there are pros and cons and the decision is linked to motivations. Hence why it is so vital for a management team to be clear on their objectives of what they want to achieve. A round-table event may represent a more focused update on specific areas of concern and can be presented far more cheaply and quickly. But the audience may well be more limited and not create the desired catalyst event to attract generalist investor attention. Equally it may be less effective at galvanizing management behind divisional and group financial targets.

The other key decision is around physical vs hybrid vs virtually-only. Of the 3 European banks hosting events in early June 2023 each chose a different one of these 3 formats. This may suggest that there is no consensus yet about which is best. Again it is likely to be linked to individual motivations. If the primary objective is to get new investors interested then some sort of hybrid or physical presence may be more of a priority. If the motivation is instead to create a shelf-life document for the next two years then virtual-only may present a better alternative.

Lessons to be learnt

Investing a huge amount of resource in presenting an Investor Day only to see the share price fall 10% or more on the day is clearly difficult for management. The best means to avoid this is to ensure that you get the content right. There is often a temptation to combine a strategy update event with a regular reporting date. However, this can compound risk. A strategy update involves management trying to shift the investor narrative towards what is achievable in the medium term. But if there is any weakness in the actual results that are reported on the day, market focus will often remain on the actual results. One simple means to avoid this is to shift the Investor Day timing to an off-cycle date – April to June and October/November are highly popular as a result.

Getting the content right may involve in the build-up listening to shareholder concerns and responding to those. There are 3 audiences for a corporate’s presentation – the sell-side analyst, buy-side analyst and buy-side generalist. At an Investor Day, far more than at a results presentation, the materials need to be appropriate and accessible to that third audience: the buy-side generalist. That means the language needs to be different, the assumed knowledge lower and the use of jargon and acronyms kept to an absolute minimum. And crucially, to attract attention the content needs to address the raised expectations bar: is it new? And is it important?

Lastly, an underappreciated element of an Investor Day is the live Q&A session at the end. There are numerous examples of Investor Days which had promising content but came unstuck under the glare of more stringent analyst and investor interrogation. Rehearsing for such an event and anticipating what the worst analyst/investor questions might look like is one means to avoid this. If such lessons are incorporated into the Investor Day preparation it may become more of the panacea that management teams hope it represents.

Recent Comments