The Q&A trends you really need to know…

The crisis affecting SVB, Signature and the Swiss private banks occurred too late in the Q4 reporting season to really influence the overall trends in questions asked of bank management teams. However, with the laggards reporting mid-March onwards it is perhaps no surprise that these late reporters did see a spike in questions focusing on uninsured deposits, held to maturity bond portfolios and more general liquidity management. Undoubtedly such topics will remain in the spotlight as we head into Q1 2023 results reporting.

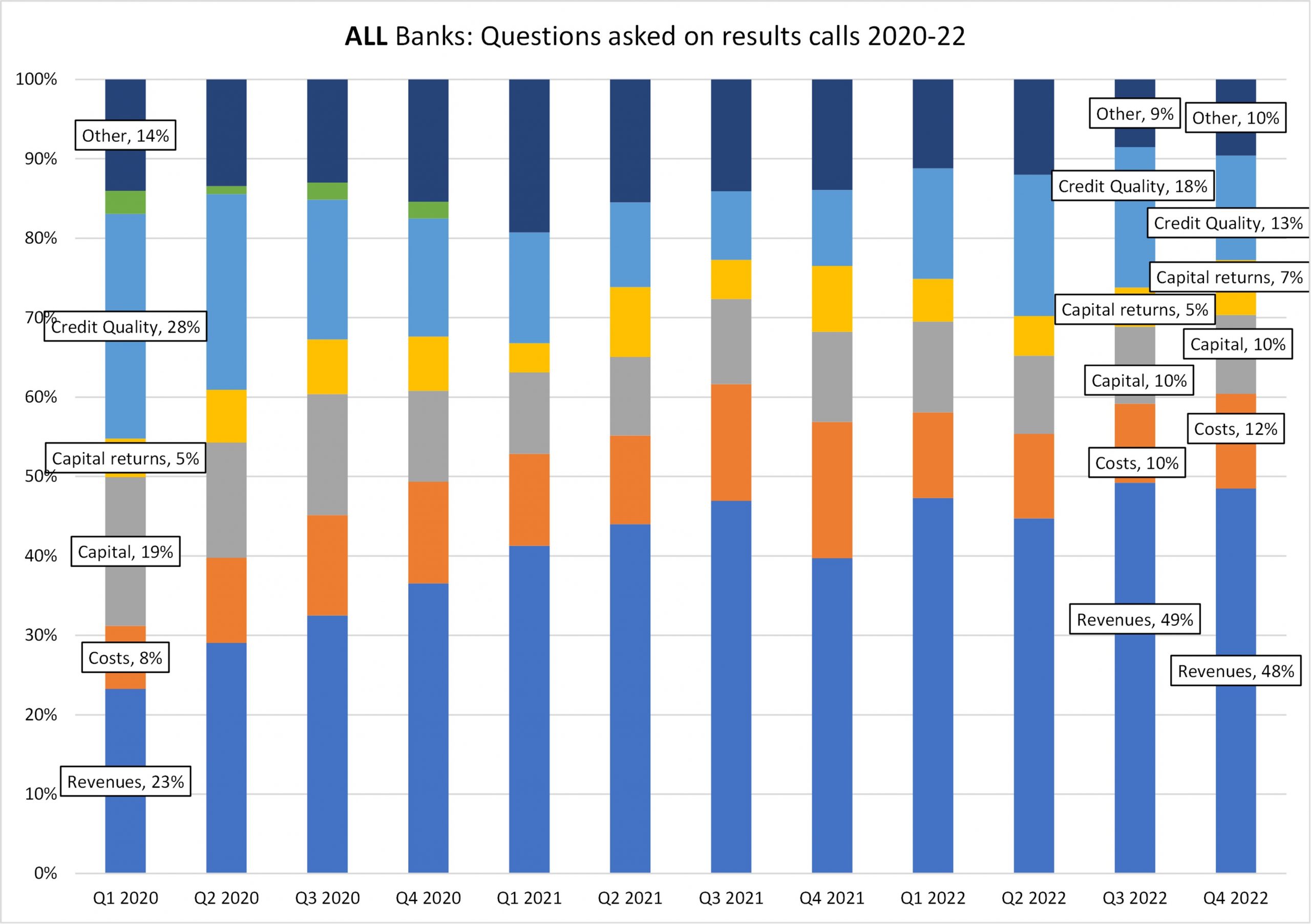

As usual we, the partners at Veritum, have performed our analysis of questions asked of financial management teams at Q4 2022 since we believe it is an invaluable barometer of what’s keeping analysts and investors up at night. For the past 3 years we have undertaken this exercise trawling through c.1400 questions per quarter asked of the top 120 US and European financial services management teams to observe changing areas of focus. In doing so our main interest is helping our retained clients prepare for what’s on the way. But we also get a lens on trends for the sector as a whole.

Perhaps there were subtle warning signs of darker clouds ahead with the proportion of questions on capital, capital returns and costs continuing to rise quarter on quarter at Q4 2022. An unintended consequence of fragile confidence in sector liquidity and marking to market of bond portfolios could be a slower pace (or stalling) of central bank rate rises. This in turn may cause inflationary pressures to remain higher for longer affecting expense projections. In aggregate banks’ net interest margins are far stronger than 12 months ago and even before central banks started to fear possible contagion risk there were suggestions that deposit betas and NIM increases were peaking. Non-performing loan formation also continues to appear benign thus far. These trends probably contribute to the reason why revenue-related questions remain near peak levels and credit quality probing remains low.

Revenue focus remains near peak levels

Looking at all US and European banks in aggregate, any concerns around balance sheet related issues (held to maturity bond portfolios or deposit flight) would be captured under the ‘Capital’ and ‘Capital Returns’ categories in the chart above. As can be seen these proportions barely moved, reflecting the fact that most financial services companies reported prior to the March SVB-related crisis. It is likely that this will be a more emergent theme when the US banks lead Q1 reporting from mid-April.

Revenue-related questions remain near record levels at 48% due to the uncertainty around speed of rate rises to curb inflation vs pushing economies into recession and related pass-through of benefits to customers. Questions around costs traditionally rise at Q4, and this period was no exception, since it is where management teams usually set guidance for the following year. Credit quality-related questioning still appears low at only 13% of total, remaining some way below the pandemic peak of Q1/Q2 2020, although there are clear differences by region. The explanation probably lies with NPL formation trends not yet showing any significant surge and historic provision stock built up in the pandemic years seeming adequate for now.

Further detail by geography

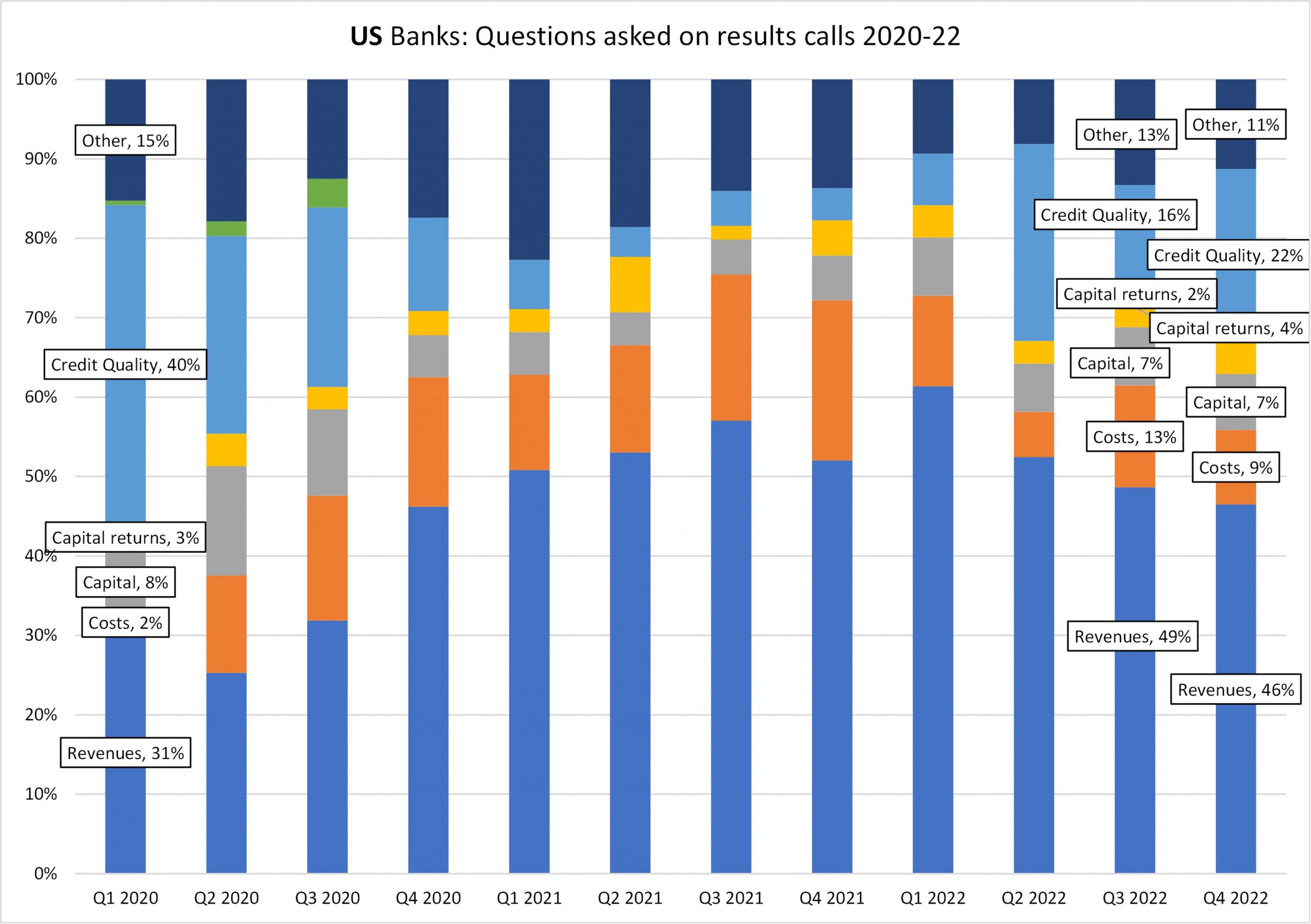

US Banks

The stand-out change at the US banks at Q4 is the large upswing in questions relating to credit quality at over a fifth of the total. However, this perhaps also suggests that Q3 2022 was a bit of an anomaly in provisioning fears temporarily falling back during that period.

The lines of questioning tended to focus on exposure to specific sectors like commercial real estate and fintech, as well as the state of play on releasing or retaining the high provision stock as well as prospects for charge off rates in 2023.

Questions relating to revenue outlook fell modestly to 46% but is still elevated, reflecting the fact that Fed interest rate direction and its impact on deposit betas and net interest margins remains relatively hard to predict.

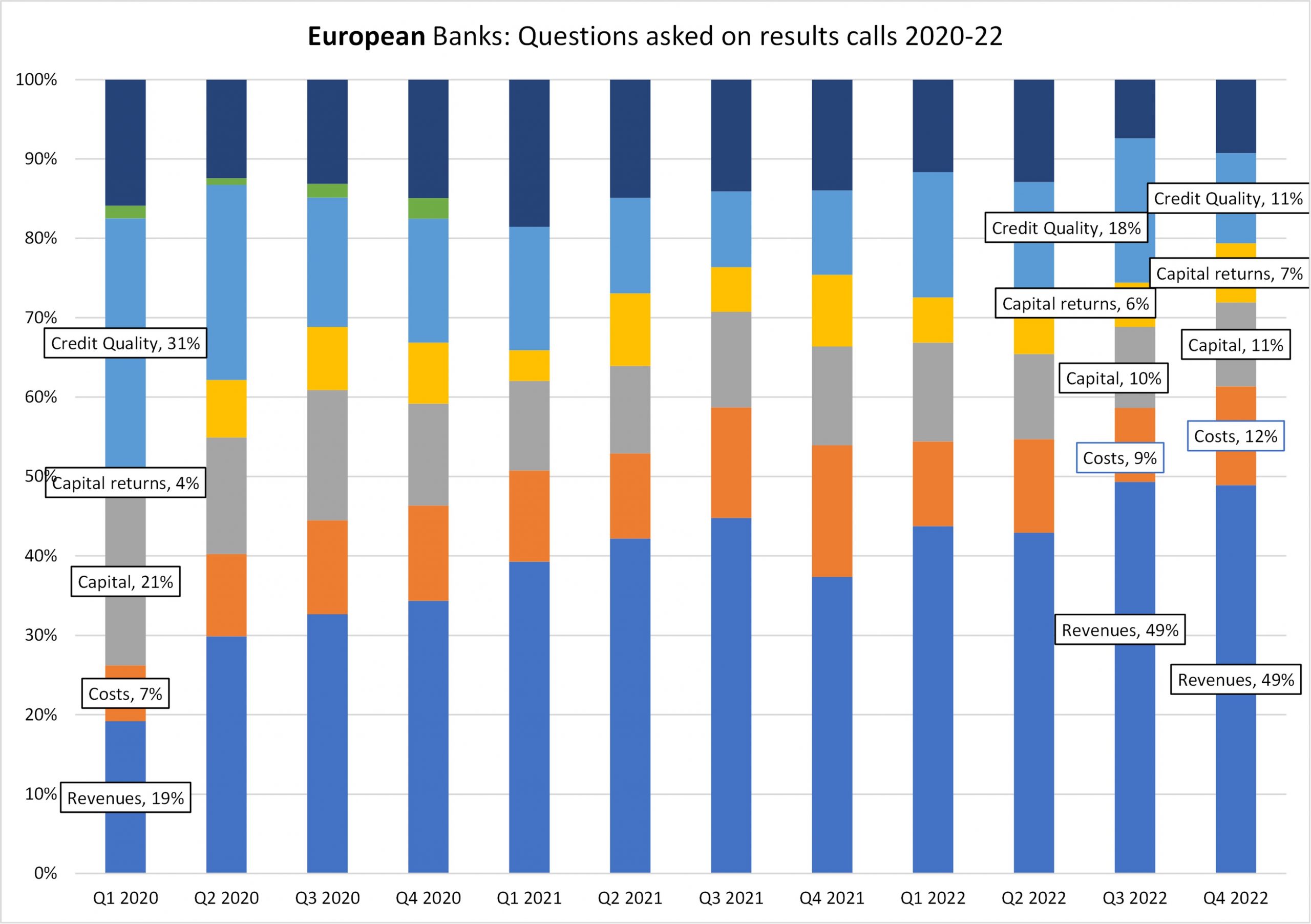

Europe

Across the European banks, questions around revenue trends similarly remained close to record levels at 49%. Within that, the clear focus was on net interest income/margins and the impact of the rising rate environment. Balance sheet related questions (the Capital and Capital returns areas) rose quarter on quarter but only modestly and credit quality fears appeared to fall back. Questions around costs rose to 12%, again reflecting concerns around necessary investment levels and staff salary increases.

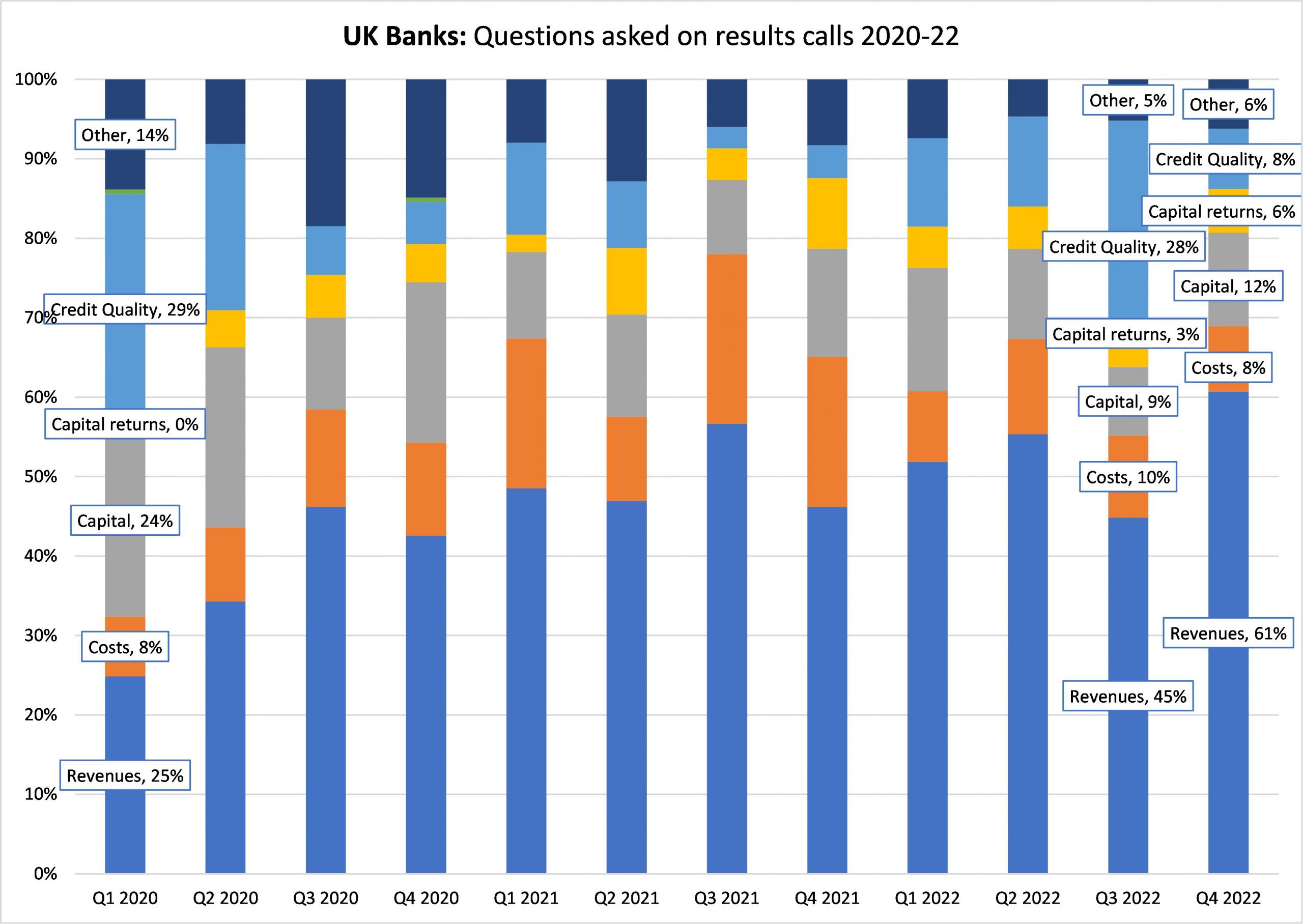

UK

The UK appears to be in contrast to other geographies with the proportion of revenue-related questions rising quarter on quarter to set a new record level of 61%. This could be a product of the political climate in the UK facing extreme pressure and uncertainty of what this may mean for future loan growth and margins. The Capital category did record quite a large upswing quarter on quarter to 12% of total. It is surprising that credit quality questions fell so much quarter on quarter and the suspicion will be that this category will rise again through 2023.

Recent Comments